Breaking even: Tackling the real cost of market downturns

Retirement should be a time to enjoy the fruits of your labor, but market volatility can turn it into a period of stress and uncertainty. Understanding the breakeven curve and strategies to mitigate market risk can help you protect your savings and ensure your financial boat stays afloat.

THE BREAKEVEN CURVE: WHAT IT MEANS

The stock market is unpredictable, and a significant downturn can have a lasting impact on your retirement savings and income. Most investors and advisors get caught up in historical average rate of returns. But is a 7% average return over a 10-year period a solid method to help you understand if your retirement is on the right track?

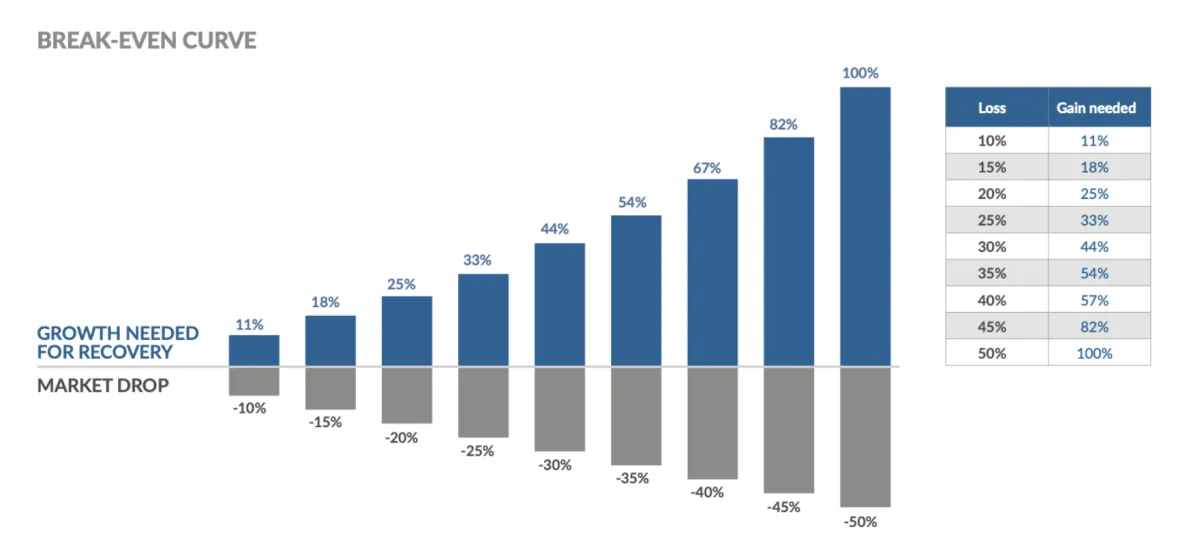

A 20% market loss in one year, for instance, requires a 25% gain the next year just to break even. This non-linear relationship highlights the breakeven curve and the true cost of market downturns - especially for those close to or already in retirement. A significant loss can force pre-retirees to delay their plans, while retirees might see their income and savings longevity at risk.

MARKET RISK: THE HIDDEN THREAT

Imagine you’ve worked diligently for decades, saving and investing to build a nest egg that will support you through your retirement years. Suddenly, a market downturn occurs, and the value of your investments plummets. This can have a cascading effect on your financial well-being. Not only might you see a significant drop in the overall value of your portfolio, but the income you were counting on to cover your living expenses could also diminish.

This scenario is particularly concerning for those who are already retired or are nearing the end of their working years, as they have less time to recover from such losses. The psychological impact of seeing your hard-earned savings shrink can also lead to anxiety and a reduced quality of life during what should be a rewarding period.

INDEXED CREDITING & THE 0% FLOOR: CREATING A SAFETY NET

To help combat these challenges, pre-retirees and retirees may want to consider retirement solutions that include indexed crediting.

Indexed crediting creates a 0% floor found in certain annuities and life insurance

products. The 0% floor is a safety net that protects your retirement income from the unpredictable drops and swings of the market. It also helps ensure that you have a steady stream of money. This mechanism is designed to prevent your investment from falling below its initial value, no matter how severe the market downturn. For retirees, this level of protection could be the game-changer for retirement. It lets them protect income without worrying about losing their hard-earned savings. Consider the 2008 financial crisis, a period marked by extreme market volatility and significant losses for many investors. During this time, those who had implemented solutions with a 0% floor were in stronger position to maintain their principal and income, while others saw their capital erode quickly. This example demonstrates the power of the 0% floor in providing a buffer against market downturns. By locking in gains at specific intervals, this strategy helps retirees build a reliable income stream over time, even in the face of economic uncertainty.

In addition to the 0% floor, other strategies can help mitigate market risk. Diversifying your investments across different asset classes, such as bonds, real estate and alternative investments, can help reduce the impact of market volatility on your portfolio. As always, it's wise to consult with a financial advisor to create a personalized, comprehensive plan that balances traditional investments with risk-mitigation strategies.

REAL WORLD EXAMPLES

From cautious savers to aggressive investors, real world examples in action provide a roadmap for those seeking to optimize their retirement income with minimal risk. One such example is the story of John and Jane, a retired couple who faced the challenge of generating a steady income without exposing themselves to significant market risk. They decided to implement a strategy that combines fixed annuities with a diversified portfolio of stocks and bonds. By setting a 0% floor on their annuity, they ensured a baseline income that would not be affected by market fluctuations. This allowed them to invest in the stock market with greater confidence, knowing that their core financial needs were protected.

Another compelling case is that of Sarah, a single retiree who had a substantial nest egg but was wary of the volatility associated with traditional investments. She adopted a strategy that involved a mix of annuities and life insurance with traditional investments. By diversifying her savings and income portfolio, Sarah was able to achieve greater peace of mind knowing her retirement had a safety net.

These examples demonstrate the power of the market risk mitigation in creating a balanced and resilient financial plan for retirement.

Whether through a combination of bonds and stocks or a focus on stocks, bonds and fixed indexed annuities and life insurance, there are strategic ways to optimize your retirement for financial security, growth and income longevity.

NEXT STEPS

Given the nature of the market, it's important to consider the following:

• Review your retirement strategy with the breakeven curve and market risk in mind

• Consult a financial advisor

• Be proactive

Want to see if risk-mitigation strategies make sense for your retirement plan? We can connect you with a licensed financial professional to help strengthen your financial future. Request a compliParagraphmentary analysis today.

For informational and educational purposes. This information has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such.

Annuities have limitations and charges. For costs and complete details, please see the contract and materials issued by the underwriting insurance company. Annuities may not be available in all states. May only be offered by a licensed insurance agent.

Annuities are products of the insurance industry and not guaranteed by any bank nor insured by FDIC or NCUA/NCUSIF. Annuities are not investments and do not directly invest in the stock market or any index. May lose value. No bank/credit union guarantee. Not a deposit. Not insured by any federal government agency.